Crypto III: On perceivd crypto advantages such as anonymity and irreversibility

Marton Trencseni - Fri 20 January 2023 - Crypto

Introduction

This is the third in a series on cryptocurrencies. All articles in this series:

- Crypto I: On cryptocurrencies, explained using FTX Tokens

- Crypto II: On fiat currencies vs. crypto currencies

- Crypto III: On perceivd crypto advantages such as anonymity and irreversibility

- Crypto IV: On stock investing vs. crypto investing

- Crypto V: On NFTs

Here I will argue that anonymity, irreversibility and decentralization, while interesting technical features that implemented in a fascinating way using cryptographic primites, are not practical for real-world use.

A simple google search for properties of crypocurrencies shows many results where key properties are summarized. This Medium blog lists the following:

- Decentralized (no central authority)

- Irreversible and immutable (cannot be undone)

- Anonymous

- Limited supply and scarcity

Here's a longer list from another page:

- Anonymity

- No intermediary or supervisory bodies

- Security

- No centralization

- Sending cryptocurrencies

- Irreversable transactions

- Fast development

Here I will talk about Anonymity, Irreversibility and Decentralization.

Anonymity

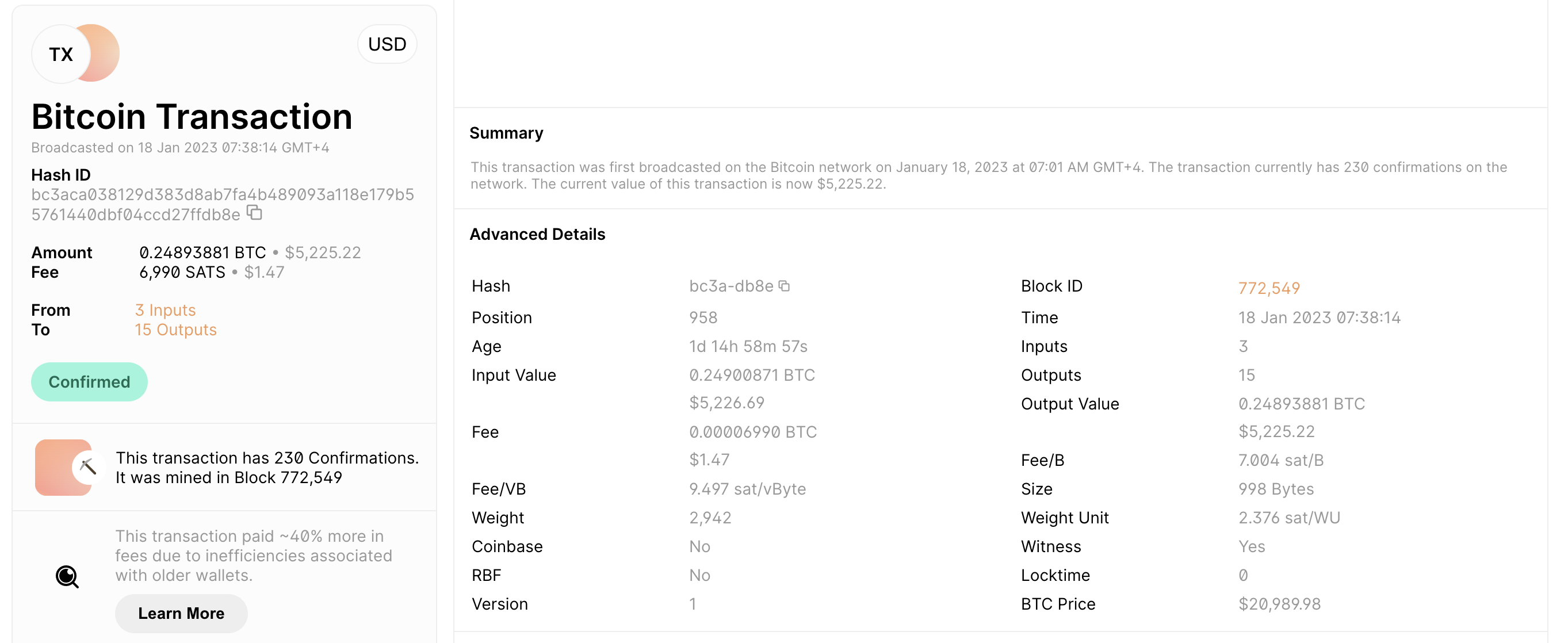

Anonymity refers to the fact that crypto transactions happen between wallets, wallets are like accounts, but don't care any additional meta information, such as name, phone number or address. A blockchain is a public database of transactions between wallets, so there are many websites that show it, for the Bitcoin blockchain, Ethereum, etc. Here is an example transactions from Bitcoin:

The point here is that the sender and receiver are identified by long unreadable strings. In the above, the sender is bc1qc09zgy8hd9ddy5mp2q4jq3gffgjvcqmn6a26lv. Clicking on the link reveals all wallet transactions (since the blockchain itself is public, since it's decentralized).

The problems can be categorized into 2 areas, technical and social.

Technically, one of the problems is that once a wallet's owner is revealed, then all past transactions involving that wallet can also be tied to the owner. So anonymity on the Blockchain is an all-or-nothing deal. If your identity gets revealed one in connection with 1 transaction, then suddenly your entire transaction history, including amounts and partner wallets, are also revealed. Suppose for example you tell a friend your wallet address bc1q9yn6zdkjjlh0z5y6sqpdvwq7pwkeh5r0ka28ad, that person sends 1 BTC; then 5 years later the FBI ask the person to reveal all identities of Bitcoin recipients, and she reveals that it's you; now the police will trivially see your complete transaction history just by visiting the above link, even if you never set foot in the US.

The main social problem is that anonymity is just not a sustainable feature. Democratic governments have legitimate reasons to know the financial (and non-financial) transactions of their citizens, for example to collect taxes or track criminals. Also, there is no technological solution to this; a nation state can simply outlaw anonymous transactions, and citizens must comply, otherwise men with guns will take them away. A common use-case for Blockchains that I hear is tracking the ownership of physical objects such as cars or land. In this case again, anonymity is a non-starter: the government needs to know who each wallet belongs to, so it can issue fines for speeding or identify the person to contact if a highway needs to be built on top of a piece of land.

Irreversibility

Irreversibility in the context of blockchains means that once a transaction is committed to the Blockchain, from a technical standpoint, it cannot be undone. This is due to the decentralized nature of the Blockchain; simply put, no single actor or node can go in and do it. Having said that, transactions are reversible in the sense that the receiver can choose to send back whatever she received to the original sender — but there is no way (technically) to force her.

The main problem here is social — sometimes you want to reverse a transaction, for example because a mistake was made and somebody typed extra zeros! It's worth pointing out that legally, if A accidentally sends too much money to B (eg. 1,000 BTC instead of 1,000 USD), B cannot just keep it.

A good example is when a crypto exchange accidentally sent $10m to an Australian woman, and then sued her to get the money back. I guess in these cases having a centralized government that can force transactions to be reversed is not so bad. It'd be great if we had software that supports this! Note that in this case, the only reason suing was even possible was that the exchange sent this money to one of its own users, whose identity was known. If this was a regular on-chain transaction to a wallet that is not managed by the exchange, undoing the mistake would be much harder or impossible.

Other, similar cases:

- Crypto.com mistakenly sent a customer \$7.2 million instead of a $68 refund

- Crypto.com sent \$400 million to the wrong recipient, but got it back this time

- FTX investigating a possible \$473 million hack

- Quora: I think someone sent me 2.041 Bitcoins accidentally. Is there a way they can reverse it? I want to keep the Bitcoins

- Quora: Someone I don't know has randomly sent me 18,500 Bitcoins. Is there a way for him to chargeback? Should I call the cops?

Decentralization

The positive arguments for decentralization are: no one person or entity controls the Blockchain, so it can't be frozen (the way a bank can freeze your assets) or tampered with. One example is that central banks, which control the supply of fiat money, can "print" new money, hence creating inflation. The argument is that, since there is no central bank with cryptocurrencies, there can be no inflation, at least by a single entity's decision to create new money.

There are multiple practical problems with this reasoning. As argued above, sometimes it's actually quite useful is an "administator" can reverse transactions, for example because the amount field contains a clerical mistake, or the destination address is non-existent and the cryptocurrencies are now lost.

Another problem is, as argued in the second article, inflation or not, the exchange rate of cryptocurrencies like BTC varies wildly, including in the inflationary direction (getting less valueble compared to USD). To a user of the currency, it doesn't really matter what the cause is, if their currency is worth 3x less real-life goods in a year's time.

Finally, as shown in the first article, for many cryptocurrencies [implemented as smart contracts on Ethereum, such as FTX and many stablecoins], it's not true that they are not inflationary. In these cases, when the initial coin is created, a large amount of reserves are also created, which are held by the creator, usually a company. This, in effect, creates control and leverage to cause inflation: if the reserves of a stablecoin start to be circulated without backing USDs, that causes the "stablecoins" to actually be worth less than the intended exchange rate (usually 1 USD), similar to inflation.

Conclusion

I have argued that anonymity, irreversibility and decentralization, while interesting technical features that implemented in a fascinating way using cryptographic primites, are not practical for real-world use.