Crypto I: On cryptocurrencies, explained using FTX Tokens

Marton Trencseni - Sat 24 December 2022 - Crypto

Introduction

Disclaimer: I have never bought, sold or owned crypto. I have no skin in the game, I just have a semi-informed opinion. If you're technical and into crypto, you may not find anything interesting here. If you find any bugs in my thinking, send comments to mtrencseni-at-gmail-dot-com.

I've been interested in the crypto space since the mid 2010s. It's a fascinating intersection of technology, economics and human psychology.

My stance towards crypto, at a very high level is:

- The use of cryptographic primitives (old and new) to create a blockchain of transactions is creative and fascinating technology.

- I am not aware of any useful, currently existing real-world applications of blockchain [that cannot be better accomplished with plain-vanilla centralized database].

- There may be useful applications of crypto technologies that we have not thought of yet.

- I believe all crypto currencies (including Bitcoin) are worth \$0.

A good starting point to understand cryptographic primitives is one of the old(er) O'reilly books on the topic, Mastering Bitcoin (free to read) by Andreas Antonopoulos. It has simple 2 line Python examples which directly demonstrate how cryptographic primitives are used in Blockchains. I read this many years ago and it was a great way to understand the technological building blocks of Blockchains and Bitcoin — highly recommended. The same author also has a second O'reilly book on the topic, Mastering Ethereum (also free to read).

All articles in this series:

- Crypto I: On cryptocurrencies, explained using FTX Tokens

- Crypto II: On fiat currencies vs. crypto currencies

- Crypto III: On perceivd crypto advantages such as anonymity and irreversibility

- Crypto IV: On stock investing vs. crypto investing

- Crypto V: On NFTs

Nature of money

I find that thinking and reading about the nature of money fascinating. In the last 10 years, it's impossible to think this topic and not ponder about the value of crypto tokens and NFTs. At the time of writing, we have just witnessed the collapse of the crypto exchange FTX, so to make it interesting, I will use the FTX exchange token FTX Token — abbreviated FTT — as an example. However, my argumentation is independent of the collapse of FTX, it equally applies to still-running tokens such Binance's Binance Coin as well.

FTT, like many other coins, is implemented as an ERC20 smart contract on top of Ethereum. The Github repo for FTT is here. It's essentially boilerplate with the actual "implementation" of the token in the 11 line file ftt/contracts/ftt.sol:

pragma solidity ^0.5.0;

import 'openzeppelin-solidity/contracts/token/ERC20/ERC20.sol';

import 'openzeppelin-solidity/contracts/token/ERC20/ERC20Detailed.sol';

import "openzeppelin-solidity/contracts/token/ERC20/ERC20Burnable.sol";

contract FTT is ERC20, ERC20Detailed, ERC20Burnable {

constructor() ERC20Detailed('FTT', 'FTX Token', 18) public {

_mint(msg.sender, 350_000_000 * 10 ** 18);

}

}

The smart contract is declaring a new token FTX Token, abbreviated FTT, with 18 decimals of accuracy and 350M of tokens minted on creation. It's good to remember that no USD valuation is set of implied here. The 18 digit accuraccy means that you can send 0.000000000000000001 FTT between wallets (17 zeros after the decimal), but you cannot send 0.0000000000000000001 (18 zeros after the decimal). The 350_000_000 * 10 ** 18 bit is a bit misleading, is it minting 350M tokens or 350M x $10^{18}$ tokens? Internally, these tokens use integer arithmetic, so technically there 350M x $10^{18}$ indivisible units. By convention 1 FTT token is $10^{18}$ units, and this determines what fractions of FTTs can be transferred between wallets.

I think it's good to look at this and remember: no value is being created here.

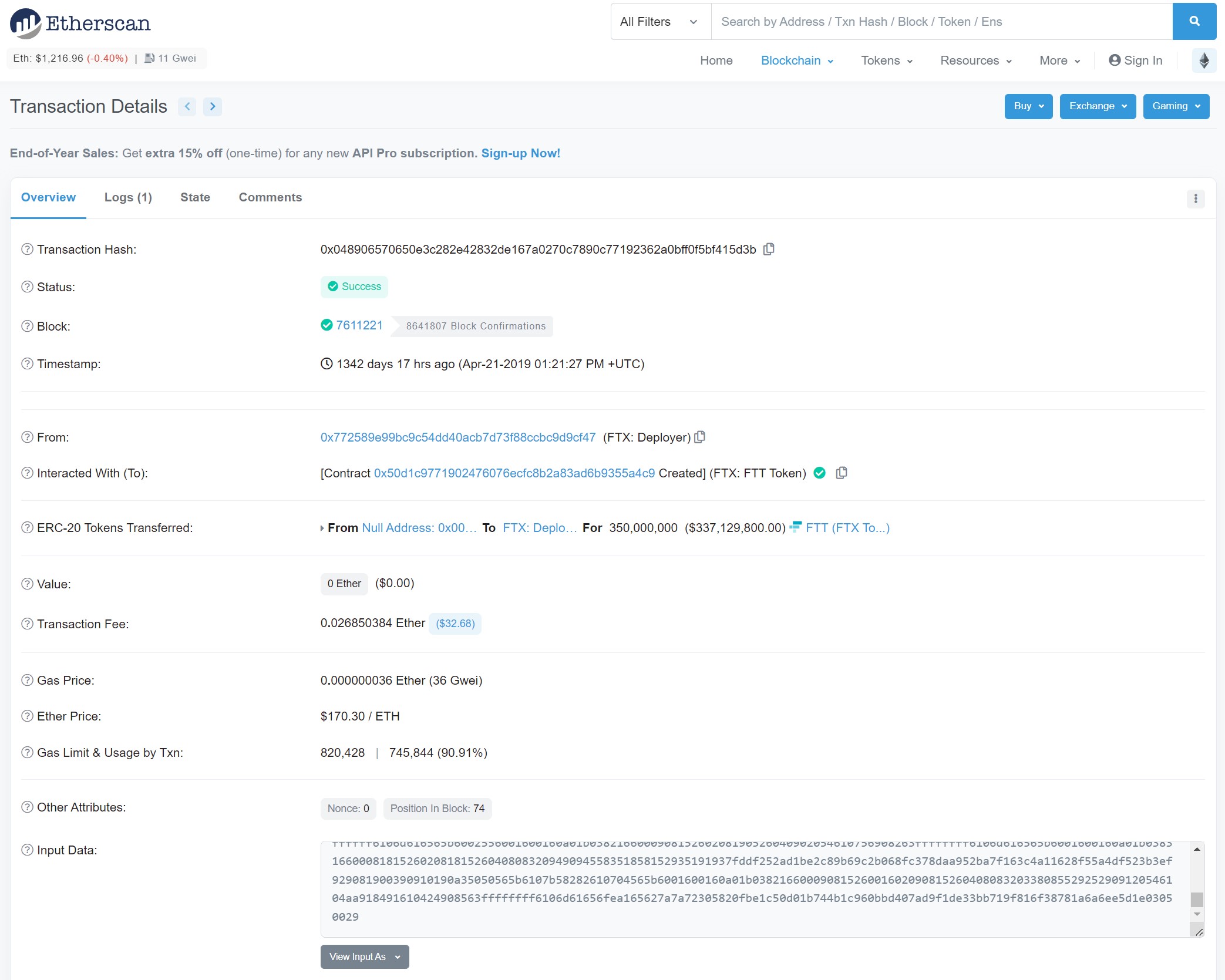

So who gets the 350M FTTs? Unsurprisingly, the wallet who executes this initial smart contract on Ethereum, msg.sender in the code. We can look at the initial transaction from 2019-04-21 13:21:27 UTC on the Ethereum blockchain to see who it is:

https://etherscan.io/tx/0x048906570650e3c282e42832de167a0270c7890c77192362a0bff0f5bf415d3b

This transaction shows up technically as coming the NULL address 0x0000000000000000000000000000000000000000 and going to the destination address 0x772589e99bc9c54dd40acb7d73f88ccbc9d9cf47 (FTX: Deployer). This is completely fine, this is just the technical act of printing 350M monopoly crypto money and calling it FTT. Note that there is a fee (called gas) of using the Ethereum blockchain and network, 0.000000036 Ether for this transaction. This initial transaction contains the smart contract that we saw on Github, with the base classes ERC20, ERC20Detailed and ERC20Burnable unwrapped:

https://etherscan.io/address/0x50d1c9771902476076ecfc8b2a83ad6b9355a4c9#contracts

Market cap

There are a lot of crypto sites that track the historic and actual USD exchange rate or ticker price (and various other metrics, such as trading volume and "market cap") of crypto tokens, including etherscan.io itself. Here's a chart for the historic FTT/USD exchange rate:

It starts off around \$1, briefly reaches a high of \$80, for a long time it moves between \$20 and \$40, and eventually crashes back to \$1 when FTX collapsed. Most of these tracker sites also display a "market cap" for coins, which for FTT would be the 350M tokens we saw in the initial transaction, times this USD rate. So initially it was around \$350M, and briefly it touched \$80 x 350M = \$28B, that's 28 billion USD.

Note: I don't know quite understand why the exchange rate is not \$0 right now. There is still trading volume, so even though FTX has crashed, some people and/or bots are still buying and selling FTTs. Since FTT is a smart contract running on Ethereum, this is certainly technically possible irrespective of the fate of FTX the company.

Value creation (or lack therof)

So here's the million dollar question: how do you go from writing an 11 line smart contract, which actually only has 2 significant lines to a \$28B valuation?

In my opinion, the simple answer is: you don't. FTT was always worth \$0, the value of these coins is just a collective delusion.

Let's use FTT as a specific example. FTT was the so-called Exchange Token for FTX. Crypto exchanges are a place to exchange fiat money like USD into crypto tokens like Bitcoin or FTT, and buy/sell between pairs of crypto tokens. Let's use the example that is most often cited as a real-world use-case (value creation) of crypto: fast hassle-free sending of money between Alice in country A and Bob in country B. Let's assume that with regular banking this is slow and cumbersome, burdened by old computer systems and KYC regulations. Let's also assume that FTX is present in both countries A and B and has bank accounts in both countries. Both Alice and Bob set up an FTX account. Bob is a Data Scientist and works for Alice, so at the end of the month Alice wants to send Bob his salary. Note that Bob wants to buy food with his \$1,000 salary, which is not possible with crypto, so he needs to get his salary in his local currency. With an exchange like FTX, the solution is:

- Alice transfers \$1,000 to FTX

- Irrespective of the current FTT/USD exchange rate (let's say it's \$2) Alice buys FTT; so she ends up with 500 FTT tokens (so now Alice owns 500 of the 350M FTT tokens)

- Alice sends the 500 FTTs to Bob (Bob's wallet)

- Bob sells the FTTs on FTX (to FTX or another user) to end up with \$999 USD

- Bob transfers the \$999 to his local account, in the process converting it to his local currency

- Bob buys a burger and eats it

Let's look at the following questions: 1. Why did Alice use FTT? Why not another token like Bitcoin? 2. Why did Bob end up with \$999 instead of \$1,000? 3. What is the actual value FTX/FTT has provided here? 4. Doesn't the above successful chain prove that FTT was worth \$2?

Why did Alice use FTT? Why not another token like Bitcoin? Per my understanding this is where Exchange Tokens are advantageous. FTX charges a fee for using its systems, the same way a traditional bank does, but less — this is completely fine. FTX tells customers that if they buy/sell FTT instead of other tokens (like Bitcoin), it will charge them less fees. This is how FTX creates demand for its tokens. It's also worth noting that this is pretty rational from Alice and Bob's perspective. In this use-case they are not speculating on the value of FTT, it is simply an in-flight tool to transfer money. Depending on the speed of the transaction, the \$1,000 will only spend a few minutes of its lifetime as FTT, then it gets converted back to USD by Bob, so the risk of FTT crashing is essentially zero.

Why did Bob end up with \$999 instead of \$1,000? This is a minor point, so I'll be brief. It's because at various points in the transaction chain FTX will charges a fee (to Alice and Bob), the same way as a traditional financial institution would — this is completely fine. In this use-case, the promise of crypto over traditional banking is that less fees will be charged and money moves faster. In my example fees totaled $1, I just made this up.

What is the actual value FTX/FTT was providing here? In this use-case, in my opinion, FTX is providing the exact same value as Wise (formely Transferwise): allowing Alice and Bob to move \$1,000 between banks in different countries, by first moving it to FTX's account in country A, and then moving it out of FTX's account in country B, for a fee — the same way Wise would charge a fee. In my opinion, that's it — the FTT token is no more important than the rows in a traditional relational database that Wise might use in its operations.

Note that what I write here does not imply that this is a useful real-world application of crypto, since the same real-world user value (transferring money between A and B) can be accomplished without a token, as demonstrated by Wise millions of times a day.

Doesn't the above successful chain of transactions prove that FTT was worth \$2? This is a key question. In my opinion, the answer is no. Let's run the following thought experiment. Let's assume the above transaction chain is the first one that is run of FTX, shortly after the initial 350M coins were minted. Hopefully we can agree that the minting process itself, those 2 lines of code, did not create value out of thin air, so the 350M FTT tokens are worth \$0. So what's the next step? Initially, FTX has \$0 in their bank account, plus they hold 350M FTTs, and Alice has \$1,000 in her bank account. The combined system has a value of \$1,000. After step 2, FTX has Alice's \$1,000 in their FTX bank account, Alice has \$0 and 1,000 FTT tokens. Hopefully we can agree that no new value was created out of thin air in the first 2 steps, so by conservation of value, the combined system still has a value of \$1,000 — which means the FTTs have to be worth \$0. In my opinion, repeating these types of transactions millions of times does not change that.

Fake money

So why do exchanges like FTX and Binance introduce their own Exchange Tokens? This is where the psychology circle of the Venn diagram comes into play, in my opinion. Many people ("crypto investors") would not agree with me on the above, they would in fact say that many-many transactions of the above type show that FTT has non-zero value — let's say it's \$1. But then, to these people, FTX can sell their remaining (of the 350M) FTT tokens for real money! From, the perspective of FTX, if there are people who believe this (and there are), then they have just created money out of thin air: they ran a few lines of smart contract on Ethereum, set up an exchange, and over and above the valuation of FTX itself (the company), they're now sitting on a bunch of monopoly money (FTT tokens) that can be sold for real money.

Note that in the above example, most of what I described is not illegal. This is not why (or, not only) FTX founders and executives are headed to jail right now. What I described above is completely standard in the crypto world. You can replace FTX with Binance and FTT with Binance Coin, it's the exact same thing. This sort of scheme also exists outside of exchanges, where something that possibly has value (a company like FTX, a game like CryptoZoo, an influncer like Logan Paul marketing reach) is "connected" to a coin by marketing, and "crypto investors" for some reason "assign" or "connect" the potentially real-world value of the original entity (the company's success/revenue/profits/valuation, the game's success/revenue/profits, the influencer's reach) to the token, and hence believe that the tokens are now worth real USDs — even though there is no contractual connection between the two!

To reflect on an aspect of the failure of FTX, and part of the reason the founders and executives are headed to jail: Even better, FTX can set up a sister company, let's call it Alameda, and Alameda can start buying and selling FTTs at increasingly higher prices! This way the USD exchange rates can climb all the way to \$80! "Crypto investors" who bought at \$1 or \$10 feel like they're making a killing because their FTX account is showing their holdings are worth a lot more USDs than they paid for it! They can even sell their FTTs at this higher price, and withdraw the USDs to their bank account, and end up with real money gains! This works only up to a point though; since no value is created in the system, if people keep selling FTTs and withdrawing USDs at a higher average price then they bought, eventually the FTX bank account will run out of money and fail. This is called a Ponzi scheme.

The value of FTX (the company) vs the value of FTT (the token)

Going back to my salary transfer example, I said that this is essentially what Wise (formely Transferwise) does. Wise is not a crypto company, however it's publicly traded, and currently has a market cap of \$5B. So it stands to reason that if FTX (the company) was doing something similar, wasn't FTX (the company) also valuable? I would say, yes!

I would agree that FTX the crypto exchange, for enabling certain useful use-cases for users, and being able to collects fees for that (just like Wise), should have a non-zero company valuation — let's say this number is \$1B. But, this has nothing to do with the FTT token's value (or lack thereof). The valuation of FTX are captured by the shares of FTX, which are held by the founders and VC investors — not by FTT token holders! There was no written or unwritten contractual connection between the valuation of FTX and FTT tokens. The proof is in the smart contract code of FTT, which was shown above! It's possible that "crypto investors" made a connection in their head, but there never was a contractual obligation backing that up.

Didn't FTX guarantee a (minimum) value of FTT?

No. If you look at the cached copy of the Terms of Service, with reference to FTT, it only says:

FTT is the exchange token of the FTX ecosystem. FTT is not being offered in the United States or to U.S. persons.

...

Note that, among other things, FTX does not guarantee the right to trade. While FTX will take all reasonable methods to ensure that accounts do not receive any unwanted fills outside of our standard liquidation procedures, risk engine, and the terms of service, FTX does not as a matter of principle have any obligation to honor people's desires for trades to have occurred that didn't.

The FTT FAQ (cached) also does not mention any guarantees.

So, you can try to sell your FTTs (or any other crypto token) on the FTX exchange, but if there are no buyers, FTX did not guarantee that they will be the buyer of last resort at some minimum exchange rate, say \$1. That's the whole point: they wanted to keep the real money for themselves! This is true for almost all token minting I believe: in the end, when all is done, the "founders" want to be left with some of the (real) USDs.

What about stablecoins?

A stablecoin is a token whose value is pegged to a traditional fiat currency. Most stablecoins are pegged to \$1 USD. FTT was not a stablecoin. The most popular stablecoins at the time of writing are:

The way stablecoins are supposed to work is roughly like this: a company releases a new stablecoin, let's say it's pegged to \$1. Technically it's the same spiel as above with FTT: the company mints a large amount of the stablecoins for itself (reserve), and then sells some of them to users for \$1 (in circulation). So users give the company \$1 and get 1 stablecoin in exchange. The company guarantees that it holds on to the \$1 in its bank accounts, ie. it doesn't squander it away. Users can then transact with their stablecoins, enjoying the benefits of cryptocurrencies. If they ever need USD, for example because they want to buy bread, or they need to pay their US taxes, they can sell their stablecoins back to the minting company and get real dollars back. Sounds great and is a very useful concept in the crypto world.

So, in this case, is there new value created? If everybody plays their part (the price of the token remains \$1 and the company holds on to the reserves), users can safely pretend that 1 stablecoin is worth \$1. So in this sense, user value is created, but the stablecoin itself has no value detached from the reserves. In reality, the company has \$1 and a liability of \$1, which nets to 0. And the user has a stablecoin, which is the other side of that liability. So the net value in the system is still \$1 (not \$2). For this reason, the minting company cannot pretend that its reserve stablecoins are worth real dollars, which is exactly what FTX did..

I came up with the following analogy to stablecoins: imagine there is a cult of finance people called Purists, living in a village called Puretown. Purists really like the feel and smell of freshly printed USDs. So they go to the bank, get 1 million \$1 bills, and bring it home to marvel at it. But they don't want to use it in circulation, because then it won't be as nice and fresh. So they photocopy each one, and agree that in their village they will use the photocopied bills to pay each other, while the Major holds on to the real USD bills in a safe at city hall. And, if they ever need a real dollar bill to transact outside their village (ecosystem), they can go back to the Major of Puretown, who holds the real USD reserves, give him a photocopied bill, and get back a real USD bill. We can agree that no value was created (they didn't magically make \$2M out of \$1M), we just have a bunch of cultists using monopoly money in their own ecosystem!

Also, it's not true that the reserves of the stablecoin (the non-circulating tokens that are still with the company) are now worth real dollars. Those are unbacked tokens, worth nothing.

The problem with stablecoins always comes from the Psychology circle in the Venn-diagram. There are two (related) failure modes:

- The minting company's executives cannot resist and will (secretly) give themselves some of the stablecoins, without putting in the equivalent backing USDs — they want to make money out of thin air. There are now unbacked stablecoins in the system, so in reality each coin is now worth less, say \$0.99 instead of \$1.00. But they attempt to keep this a secret, so everybody believes and/or pretends the coin is worth \$1 (the exchange rate charts still show \$1), and withdraws per that exchange rate when getting back real dollars. Eventually the company runs out of money. This could be caused because somebody suspects or finds the unbacked trades, tweets about it, and a bank run happens.

- The minting company is supposed to hold on to the USD reserves, but the company's executives cannot resist and start making risky investment bets with the money, with the hope of turning the reserves into more money (and keeping the difference). Eventually one of the trades doesn't work out, and the reserves are now under water compared to the stablecoins in circulation. As in the previous failure case, a stablecoin is now worth less, say \$0.99 instead of \$1.00. But they attempt to keep this a secret, so everybody believes and/or pretends the coin is worth \$1... same story.

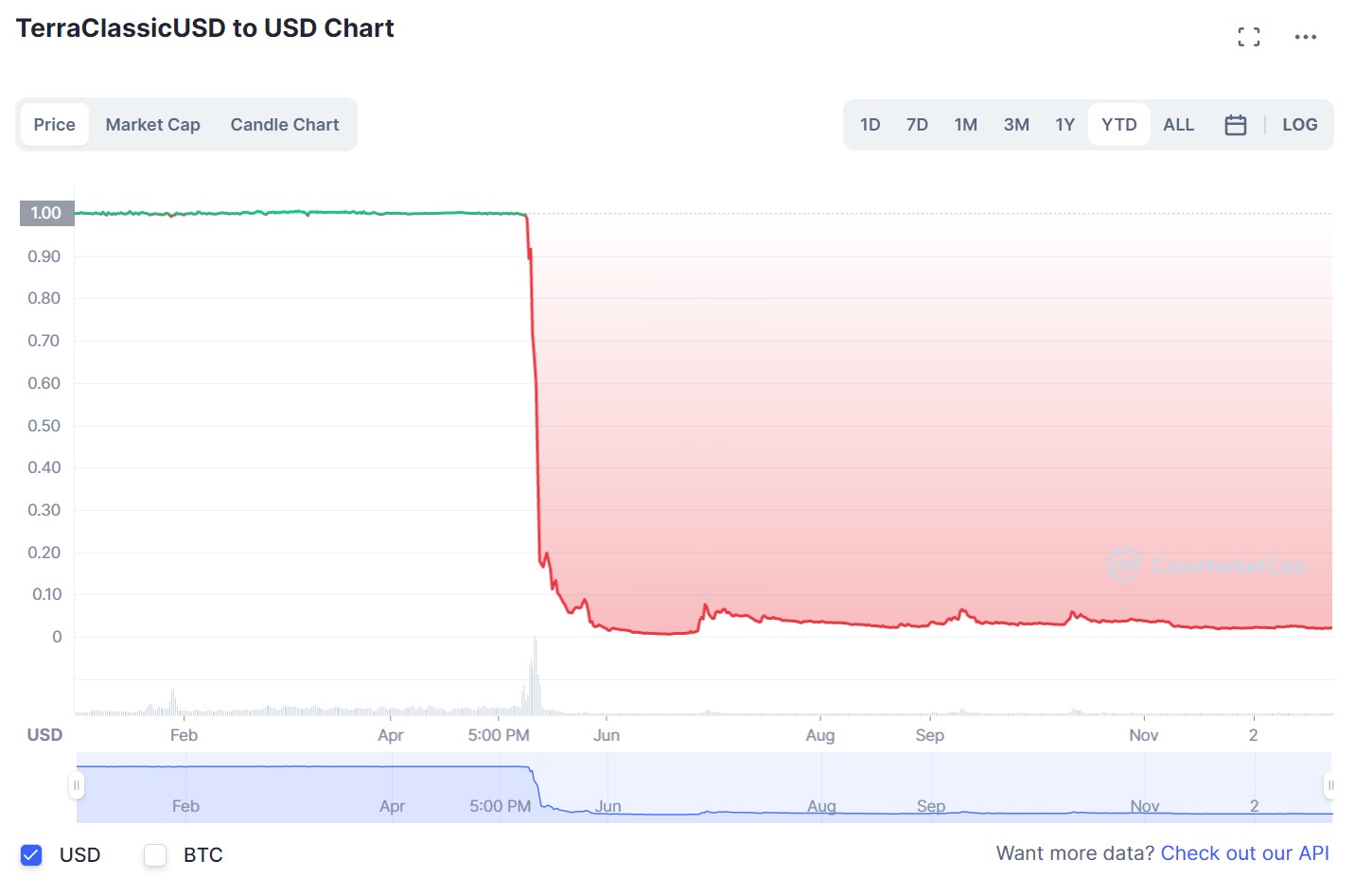

Note: there are also algorithimic stablecoins, which do not have any backing USDs at all. These are supported pure fantasy disguised as complex algorithmic mumbo-jumbo. The most famous of these was Terra, which got "de-pegged" this year:

Why is everything shown in USD?

One thing I always chuckle at is that all the crypto coins are always tracked per the USD exchange rate — that seems to be the topline metric. This is ironic, as crypto was supposed to be a better alternative to fiat money, and by now we have thousands of coins/tokens floating around — yet everything is always measured in USDs. I suspect that deep down the smart players know that the coins are worthless...

Would I buy BTC at \$1?

The last thought experiment for this article is the following. The BTC/USD exchange rate right now is \$16,821. Suppose somebody offers to sell me BTC at \$1. To make it even interesting, let's suppose this offer is coming from Satoshi, the original creator of Bitcoin, whose (untouched) wallet from 10+ years ago still holds about 1M Bitcoins. Would I take it, and then immediately re-sell it at \$16,821?, and make \$16,820 in profits? Or would I stick to what I argued in this article and not buy — because why would I pay \$1 for something that I believe is worth \$0?

Fundamentally I believe that buying Bitcoin is pure speculation. There is no value being being created, so any money being made when anybody sells their BTC for USD is somebody else's USD (without additional value being created in the process for either party). So my win is your loss, and vica versa. So any money I win, somebody loses. So in the above thought experiment, if I buy Satoshi's BTC for \$1, with previously untouched ("unbacked") BTC being introduced into the system, and then sell it immediately at \$16,821 to Alice, then overall, I'm taking \$16,820 off the collective gambling stakes — other people's money.

So in my opinion, this is like saying: there's a bunch of people playing poker, the pool money is already very high. Satoshi shows me a sure way to beat the other players and take some money off the table, risk-free — would I do it? Let's suppose there are just 2 other poker players, and I know them well, they are my friends. Would I do it? How about if there are a million faceless poker players, and the games are being conducted over the Internet?

The proof is in the pudding, so I don't know what I would do. But fundamentally I'm against taking other's people's money without a fair exchange of value.

Conclusion

Crypto is a beautiful, but unregulated and hence dangerous intersection of technology, economics and human psychology. I often use thought experiments to try to remove smoke and unnecessary complications when trying to understand the crypto world. Here I shared some of these, using FTX's FTT token as an example.

I plan to write follow-up posts, where I will:

- Argue why I think most use-cases for smart contracts aren't practical in the real world — including tokens, NFTs and others.

- Argue why I think that buying and selling traditional stock (such as Google or Microsoft stock) is fundamentally different than buying and selling tokens and NFTs.

- Explain why I think some of the crypto community's criticism of fiat money, central banks and regulation are actually a good thing.