Stock returns of simple trading strategies

Marton Trencseni - Fri 22 March 2024 - Finance

Introduction

In the previous posts, I looked into the stability of volatilities of various securities, using different volatility measures, and found that there are significant year-over-year differences:

- Introductory investigations into the stability of stock price volatility

- The volatility of simple trading strategy returns

In this article, I clean up the code that I wrote to make it more modular and reusable across experiments.

Tidying the code

First, some helper functions:

def take(series, i):

return [x[i] for x in series]

def first(series):

return take(series, 0)

def second(series):

return take(series, 1)

I don't like working with Pandas DataFrames, I find the API unintuitive --- I prefer working with native Python structures. I'll convert the df returned by yfinance to a list of tuples:

def extract_series(df, ticker, metric):

return list(zip(list(df.index.astype(str)), list(df_tech[metric][ticker])))

Next, given such a list of stock prices, a helper function to convert it to daily absolute USD returns. This returns a list that is 1 shorter than the input list:

def daily_returns(series):

return [(series[index][0], (series[index][1] - series[index-1][1]) / series[index-1][1]) for index in range(1, len(series))]

Next, a simple function that converts returns to log-returns. Log-returns are useful, because unlike raw returns, they are additive:

def log_returns(series):

return [(item[0], log(item[1])) for item in series]

Next, a function that computes returns of a take-profit/stop-loss trading strategy, assuming we have an ensemble of traders, one starting the strategy every day:

def execute_strategy(prices, take_profit_price, stop_loss_price):

for daily_price in prices:

if daily_price >= take_profit_price:

return take_profit_price

if daily_price <= stop_loss_price:

return stop_loss_price

return prices[-1]

def strategy_returns(series, position_length, take_profit, stop_loss, max_price=None):

returns = []

prices = second(series) # extract prices

for i, start_price in enumerate(prices[:-position_length]):

if max_price is not None and start_price >= max_price:

continue

final_price = execute_strategy(

prices=prices[i+1:i+1+position_length],

take_profit_price=start_price*take_profit,

stop_loss_price=start_price*stop_loss

)

r = (final_price - start_price) / start_price

returns.append(r)

trading_ratio = len(returns)/(len(series)-position_length)

return list(zip([x[0] for x in series], returns)), trading_ratio

Next, a Python version of GROUP BY, to extract monthly or yearly stats:

def bucketize(series, group_by, compute_func=lambda x:x):

buckets = defaultdict(lambda: [])

for (day, r) in series:

buckets[group_by(day)].append(r)

return [(key, compute_func(value)) for (key, value) in buckets.items()]

Visualization

With this, it's simple to reproduce the results from the previous post, but in a modular way:

tickers = ['AAPL', 'MSFT', 'TSLA', 'META', 'GOOG']

df_tech = yf.download(tickers, '2014-01-01', '2023-12-31') # last 10 years

year_days = 262

ticker = 'TSLA'

metric = 'Adj Close'

s = extract_series(df_tech, ticker, metric)

daily_rets = daily_returns(s)

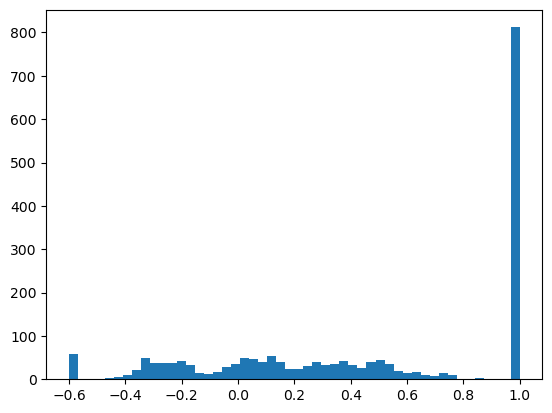

strategy_rets, _ = strategy_returns(s, position_length=2*year_days, take_profit=2, stop_loss=0.4)

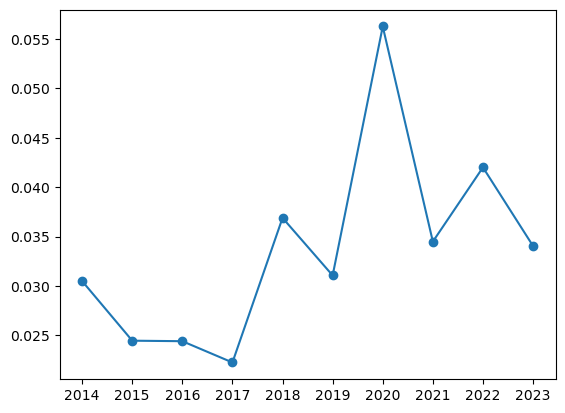

daily_rets_per_year = bucketize(daily_rets, group_by=lambda s: s[:4], compute_func=stdev)

pf1 = plt.figure(1)

plt.hist(second(strategy_rets), bins=50)

pf1.show()

pf2 = plt.figure(2)

plt.plot(first(daily_rets_per_year), second(daily_rets_per_year), marker='o')

pf2.show()

Outputs:

Backtesting simple trading strategies

With these helper functions, it's simple to check the historic success of our trading stategies. Let's check them for our favorite 5 tech stocks (['AAPL', 'MSFT', 'TSLA', 'META', 'GOOG']) for the past 5 years. We are willing to hold the position for 1 calendar year, and have a take-profit/stop-loss margin of 50%, what is our win rate (how often do we make a positive return), how often do we enter the position given max_price, what is the average return % (and what is it only counting cases where we actually made a positive return)?

tickers = ['AAPL', 'MSFT', 'TSLA', 'META', 'GOOG']

df_tech = yf.download(tickers, '2019-01-01', '2023-12-31') # last 5 years

position_length=1*year_days

take_profit=1.50

stop_loss=0.5

max_price = None

print(f'PARAMS: take profit={take_profit:.2f}, stop loss={stop_loss:.2f}, position length={position_length}, max price={max_price}')

for ticker in tickers:

strategy_rets, trading_ratio = strategy_returns(

extract_series(df_tech, ticker=ticker, metric='Adj Close'),

position_length=position_length,

take_profit=take_profit,

stop_loss=stop_loss,

max_price=max_price,

)

win_rate = mean([int(r > 0) for r in second(strategy_rets)])

avg_return = mean([r for r in second(strategy_rets)])

avg_return_cond_win = mean([r for r in second(strategy_rets) if r > 0])

print(f'ticker={ticker} -> trading ratio={trading_ratio:.2f}, win rate={win_rate:.2f}, avg return={avg_return:.2f}, when winning={avg_return_cond_win:.2f}')

Prints:

PARAMS: take profit=1.50, stop loss=0.50, position length=262, max price=None

ticker=AAPL -> trading ratio=1.00, win rate=0.88, avg return=0.30, when winning=0.35

ticker=MSFT -> trading ratio=1.00, win rate=0.81, avg return=0.29, when winning=0.39

ticker=TSLA -> trading ratio=1.00, win rate=0.72, avg return=0.21, when winning=0.48

ticker=META -> trading ratio=1.00, win rate=0.63, avg return=0.08, when winning=0.38

ticker=GOOG -> trading ratio=1.00, win rate=0.73, avg return=0.19, when winning=0.34

So this strategy had a pretty good win rate in the tech sector recently. As a trader, we can be smarter, and only start such a strategy if the price is "low". Let's define "low" as the mean of the price over this 5 year period (note that this logic is leaking the future into the past):

tickers = ['AAPL', 'MSFT', 'TSLA', 'META', 'GOOG']

df_tech = yf.download(tickers, '2019-01-01', '2023-12-31') # last 5 years

position_length=1*year_days

take_profit=1.50

stop_loss=0.5

print(f'PARAMS: take profit={take_profit:.2f}, stop loss={stop_loss:.2f}, position length={position_length}')

for ticker in tickers:

s = extract_series(df_tech, ticker=ticker, metric='Adj Close')

max_price = mean(second(s))

strategy_rets, trading_ratio = strategy_returns(s,

position_length=position_length,

take_profit=take_profit,

stop_loss=stop_loss,

max_price=max_price,

)

win_rate = mean([int(r > 0) for r in second(strategy_rets)])

avg_return = mean([r for r in second(strategy_rets)])

avg_return_cond_win = mean([r for r in second(strategy_rets) if r > 0])

print(f'ticker={ticker}, max price={max_price:.1f} -> trading ratio={trading_ratio:.2f}, win rate={win_rate:.2f}, avg return={avg_return:.2f}, when winning={avg_return_cond_win:.2f}')

Prints:

PARAMS: take profit=1.50, stop loss=0.50, position length=262

ticker=AAPL, max price=121.4 -> trading ratio=0.51, win rate=1.00, avg return=0.47, when winning=0.47

ticker=MSFT, max price=231.3 -> trading ratio=0.57, win rate=1.00, avg return=0.46, when winning=0.46

ticker=TSLA, max price=170.9 -> trading ratio=0.48, win rate=0.96, avg return=0.46, when winning=0.50

ticker=META, max price=235.5 -> trading ratio=0.60, win rate=0.82, avg return=0.25, when winning=0.40

ticker=GOOG, max price=98.7 -> trading ratio=0.56, win rate=0.97, avg return=0.38, when winning=0.39

For most of these tech stocks, this strategy would have yielded very good win rates and returns.

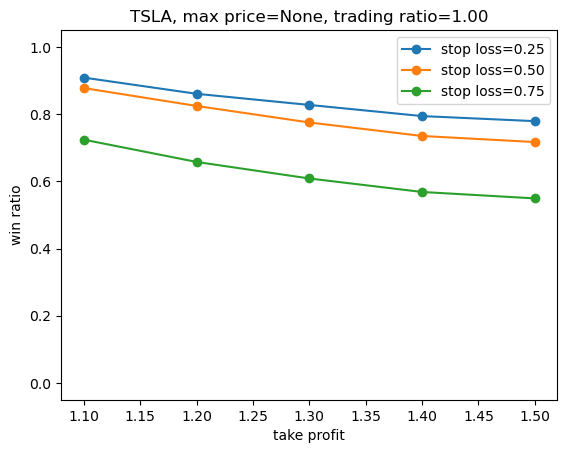

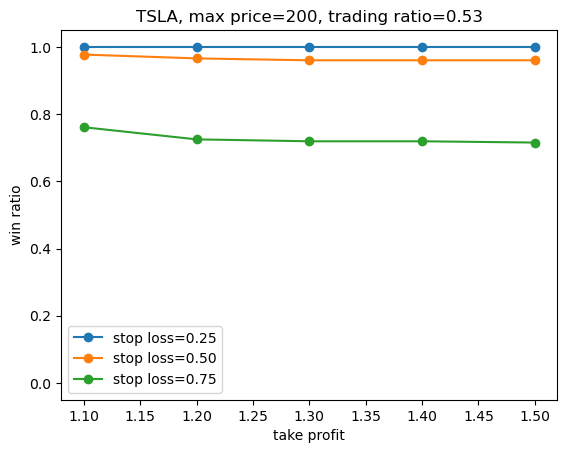

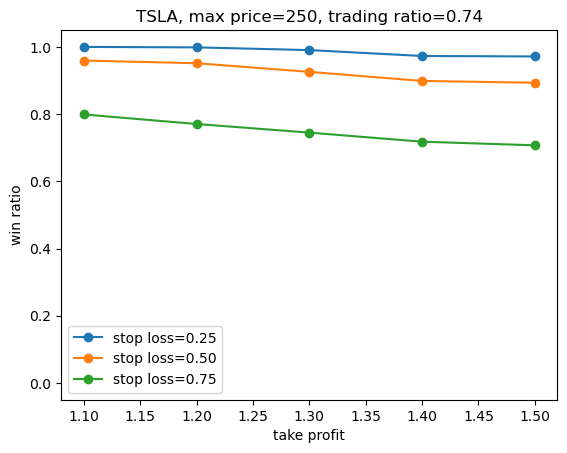

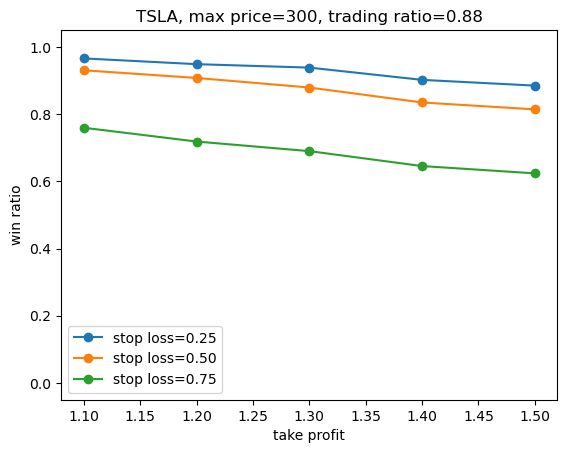

Let's plot the win rate for TSLA as a function of take profit, for different stop loss values. First, a helper function:

def plot_win_rate(df, ticker, metric,

position_length=1*year_days,

take_profits = [1.10, 1.20, 1.30, 1.40, 1.50],

stop_losses = [0.25, 0.50, 0.75],

max_price=None):

results = defaultdict(lambda: [])

s = extract_series(df, ticker, metric)

for take_profit in take_profits:

for stop_loss in stop_losses:

strategy_rets, trading_ratio = strategy_returns(s, position_length, take_profit, stop_loss, max_price)

win_ratio = mean([int(r > 0) for r in second(strategy_rets)])

results[stop_loss].append((take_profit, win_ratio))

# plot:

legends = []

for stop_loss, li in results.items():

legends.append(f'stop loss={stop_loss:.2f}')

plt.plot(first(li), second(li), marker='o')

plt.title(f'{ticker}, max price={max_price}, trading ratio={trading_ratio:.2f}')

plt.xlabel('take profit')

plt.ylabel('win ratio')

plt.ylim((-0.05, 1.05))

plt.legend(legends)

Let's use it:

plot_win_rate(df_tech, ticker='TSLA', metric='Adj Close', max_price=None)

plot_win_rate(df_tech, ticker='TSLA', metric='Adj Close', max_price=200)

plot_win_rate(df_tech, ticker='TSLA', metric='Adj Close', max_price=250)

plot_win_rate(df_tech, ticker='TSLA', metric='Adj Close', max_price=300)

Result:

Conclusion

In retrospect I'm surprised how useful these 10 functions are. Tidying up this code has paid valuable dividends and given me trading ideas. I will continue this series with further investigations of volatility, CAPM and various simple strategies.