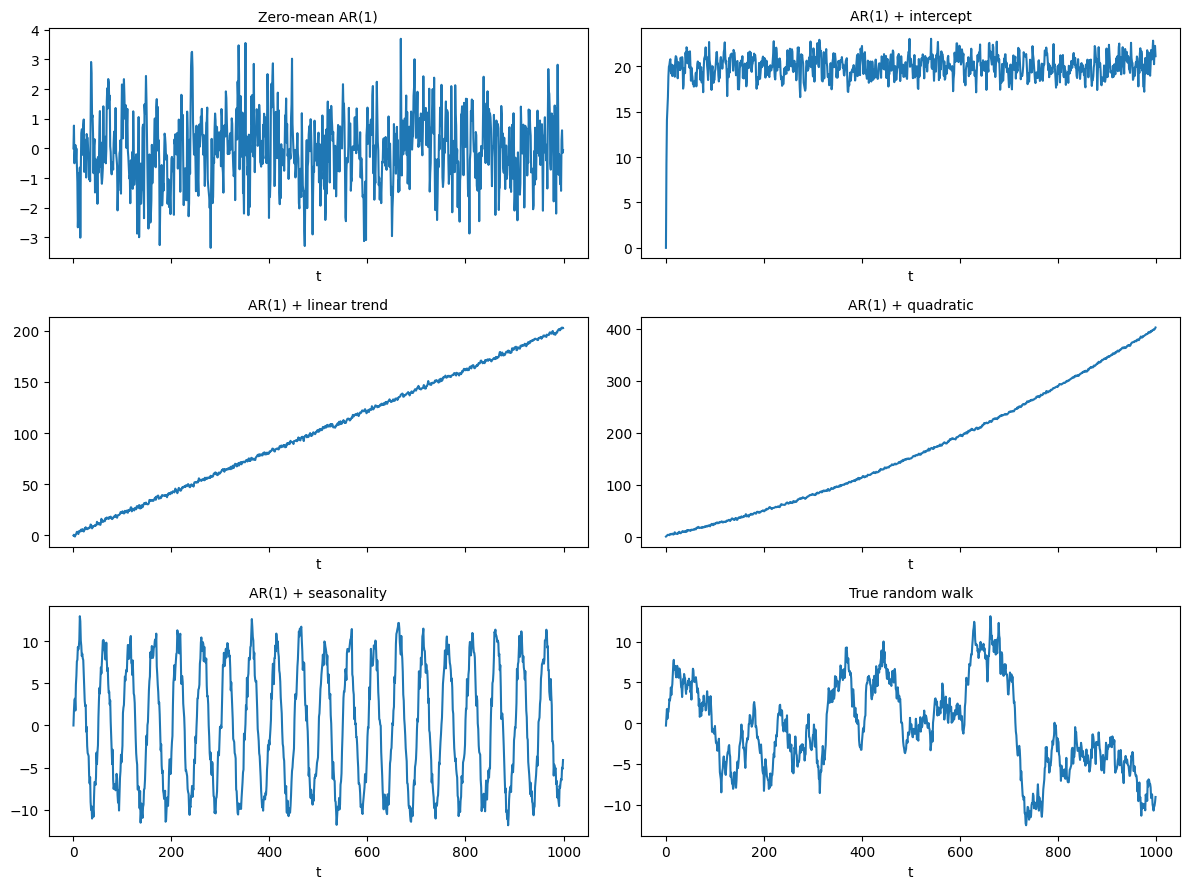

White noise into random walks

Marton Trencseni - Sun 04 May 2025 • Tagged with trading, random walks

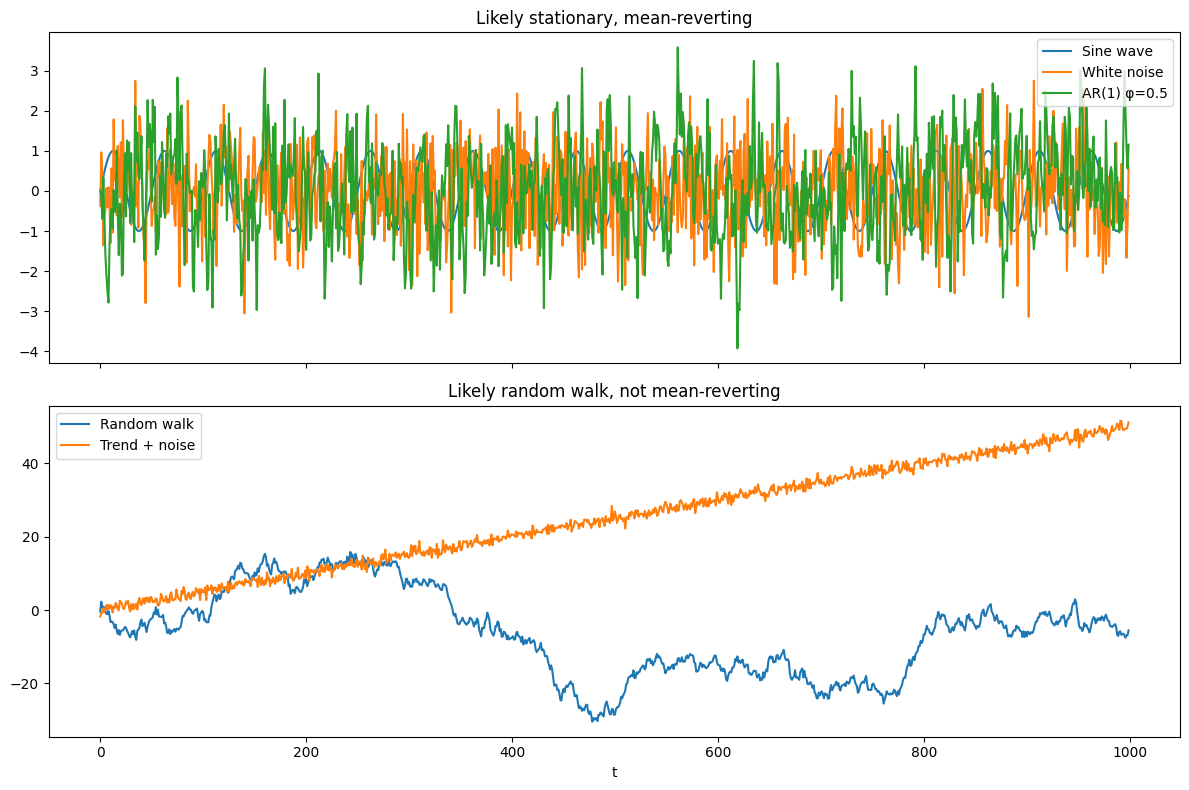

A visual and analytical walk from pure white noise to a true random walk.

Marton Trencseni - Sun 04 May 2025 • Tagged with trading, random walks

A visual and analytical walk from pure white noise to a true random walk.

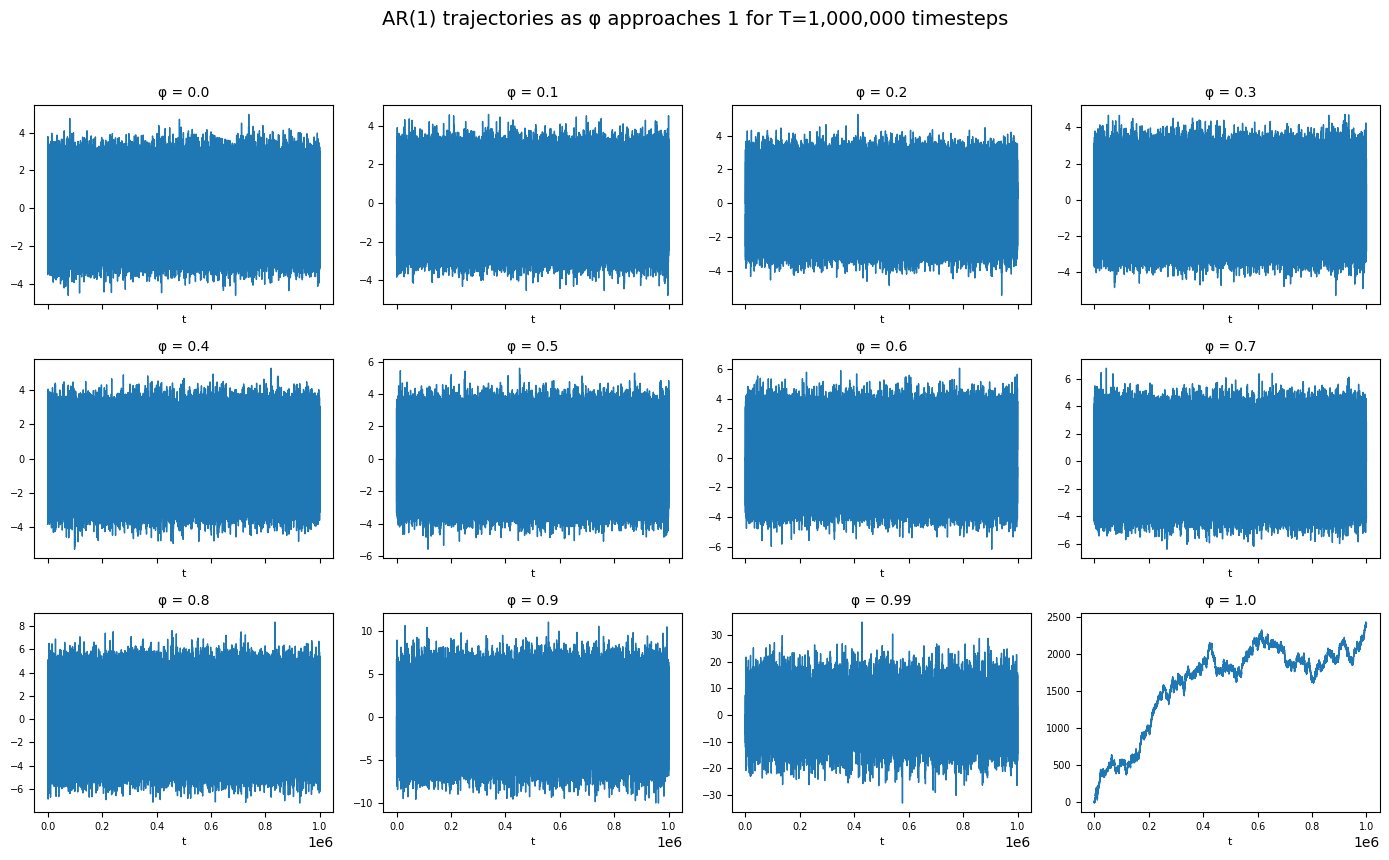

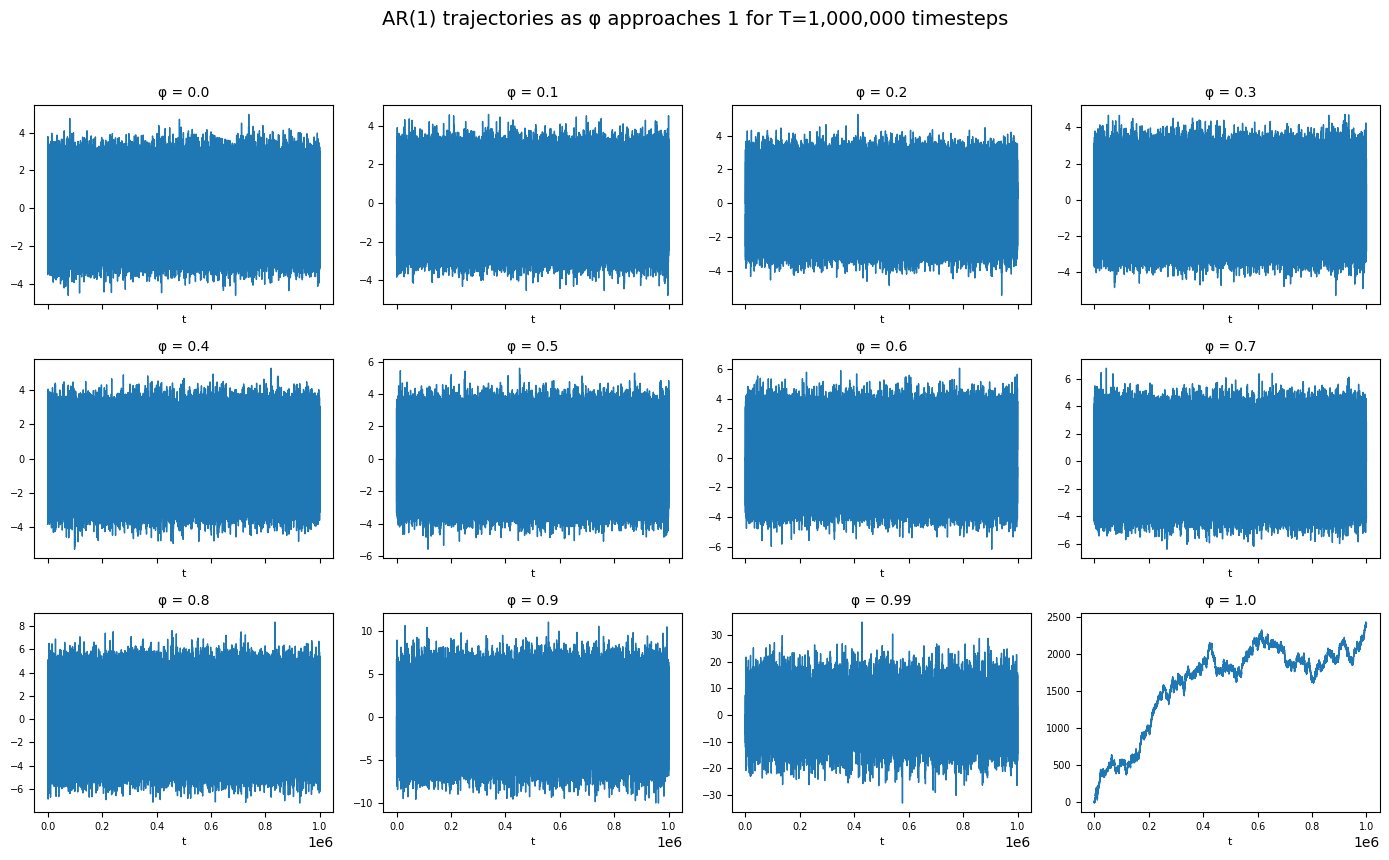

Marton Trencseni - Sat 26 April 2025 • Tagged with trading, random walks, dickey-fuller

The article examines how simple autoregressive stochastic processes behave with the Dickey-Fuller test.

Marton Trencseni - Sun 20 April 2025 • Tagged with trading, random walks, dickey-fuller

This post explores how to use the Dickey–Fuller test to check the random‑walk hypothesis for time series using a pure NumPy implementation, and using Monte Carlo simulations to compute critical‑value tables.

Marton Trencseni - Sun 16 March 2025 • Tagged with trading, sharpe ratio, win ratio, nasdaq

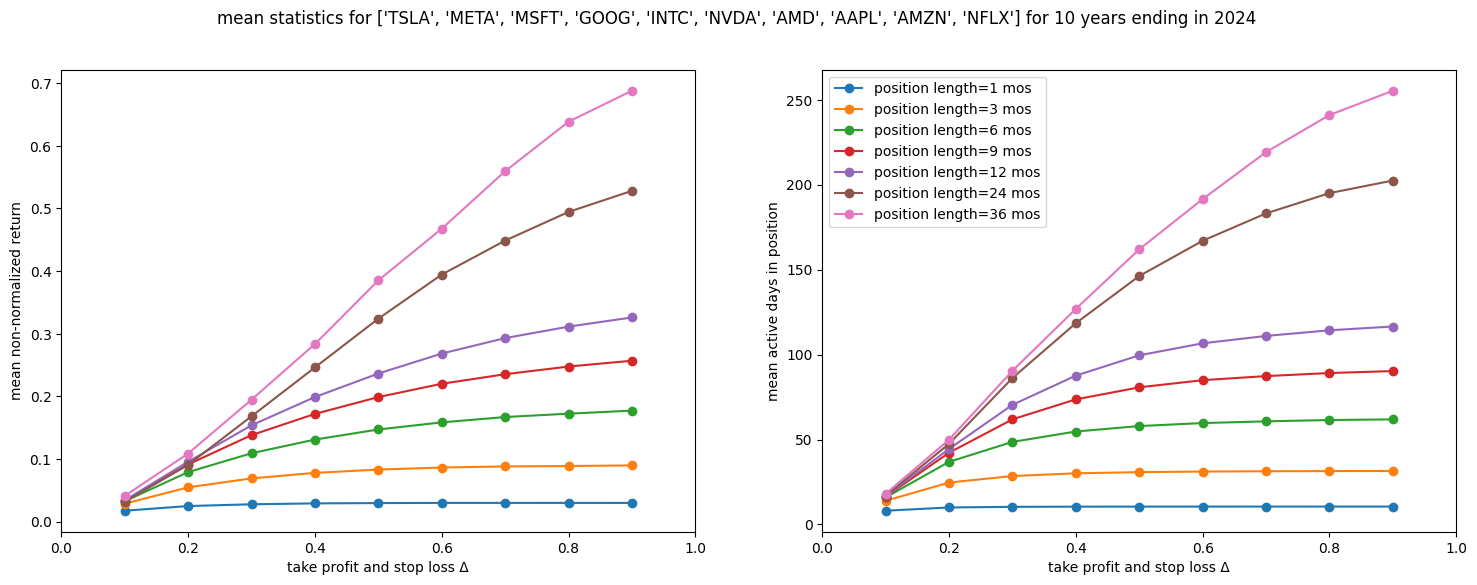

In this follow-up, I analyze 10 years of data on a select group of stocks to show that while higher take-profit and stop-loss thresholds boost win ratios and Sharpe ratios, longer holding times can lower annualized returns.

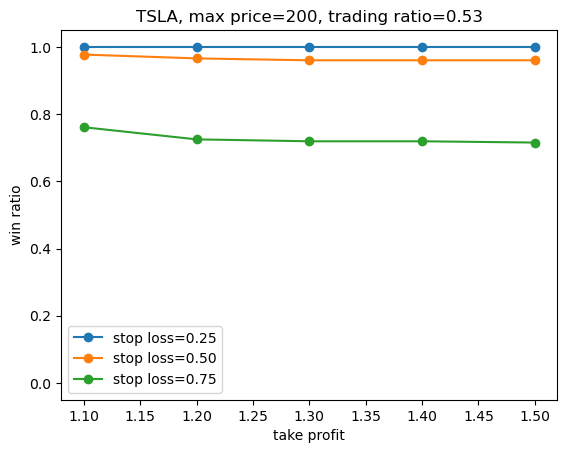

Marton Trencseni - Sun 09 March 2025 • Tagged with trading, sharpe ratio, win ratio, nasdaq

In this article, I explore how adopting longer-term, resilient trading strategies with higher take-profit and stop-loss thresholds can deliver more consistent, risk-adjusted performance.

Marton Trencseni - Mon 30 December 2024 • Tagged with markowitz, portfolio, capm, volatility

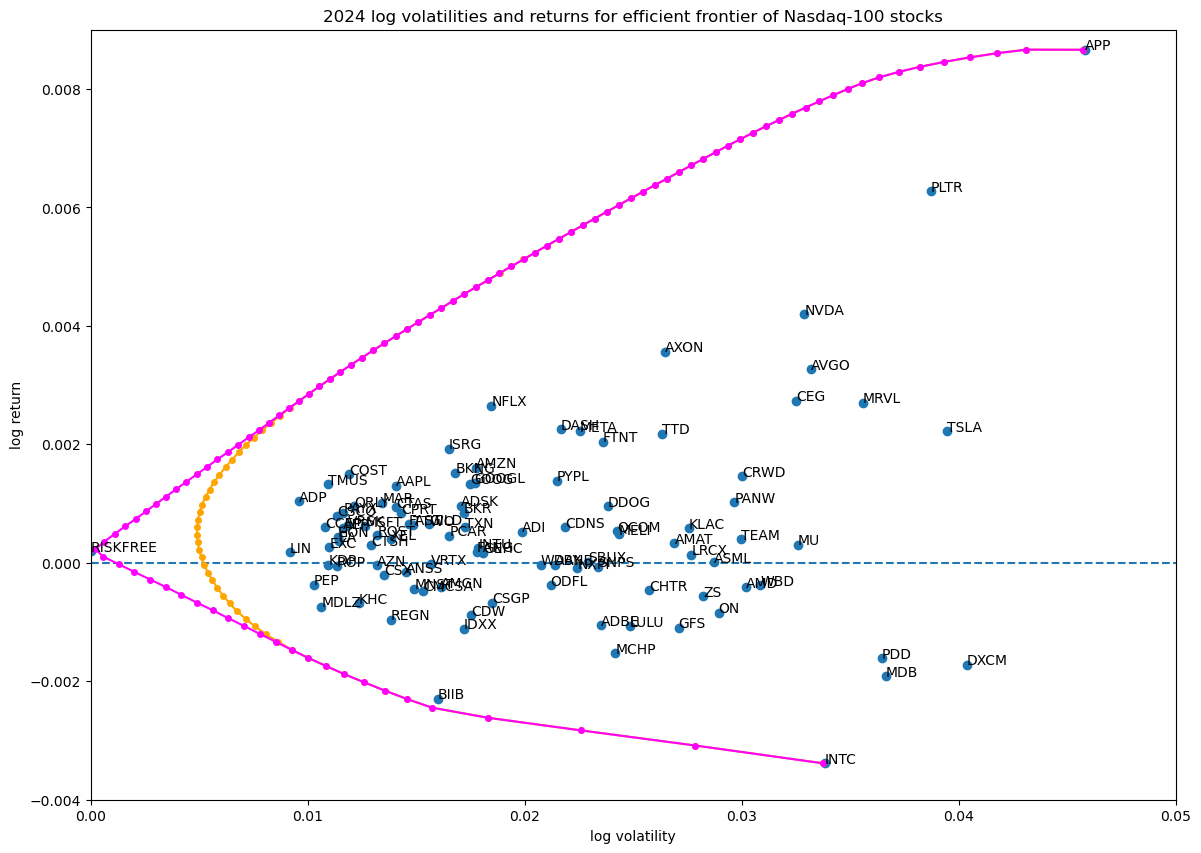

In the previous two articles, we explored the coverage of random portfolios in log volatility—return space, both with and without a risk-free asset. We now take the next step, and calculate the Efficient Frontier and Capital Market Line of Markowitz’s theory.

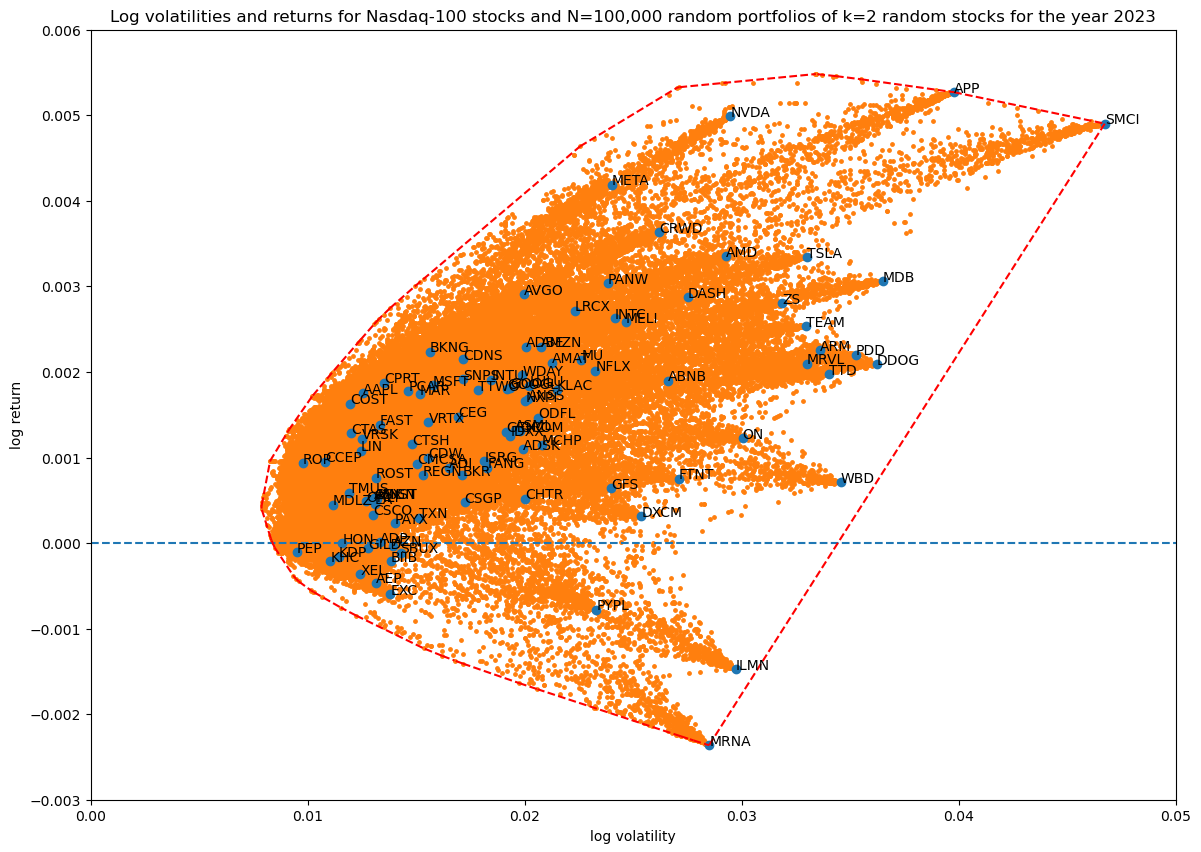

Marton Trencseni - Fri 20 December 2024 • Tagged with markowitz, portfolio, capm, volatility

In a previous article I simulated random portfolios using Monte Carlo methods for the 2023 daily closing prices of the 100 stocks constituting the Nasdaq-100. Here I add the risk-free asset to the portfolio and examine how it affects the coverage in log volatility—return space.

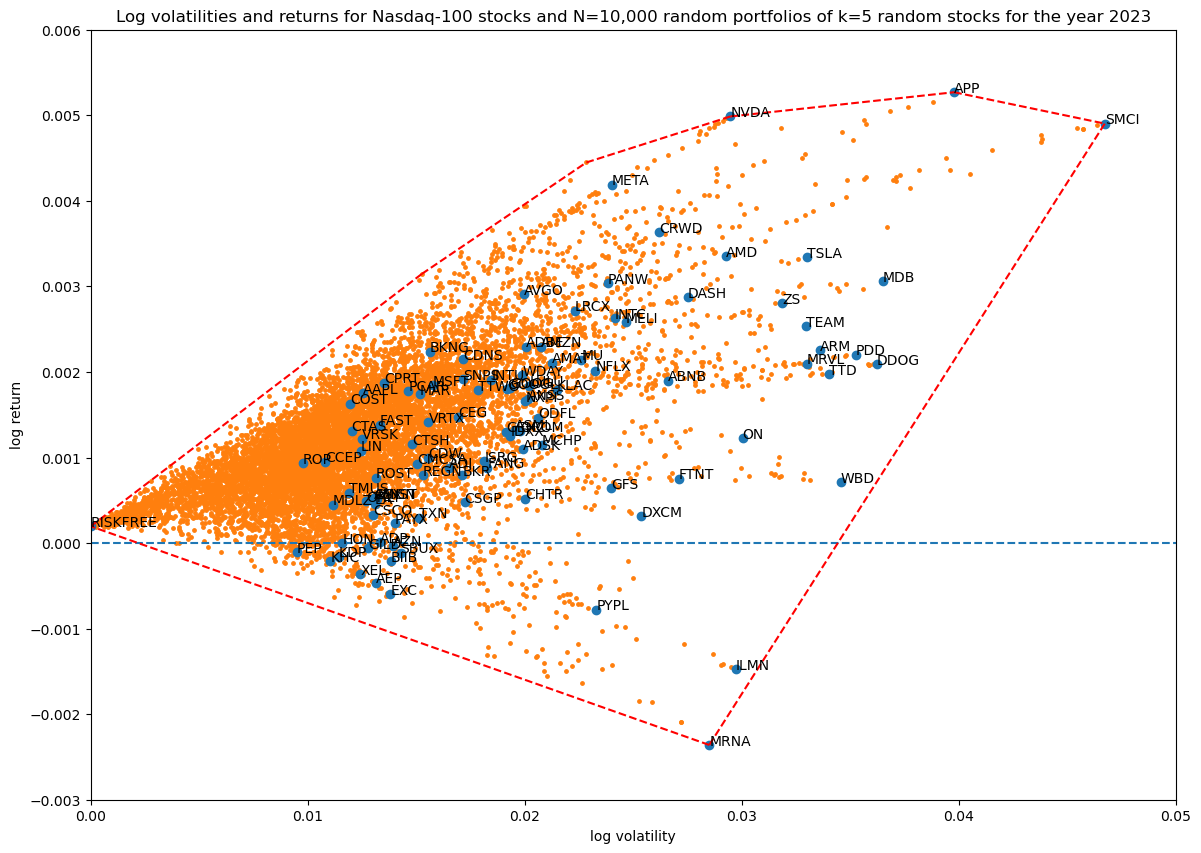

Marton Trencseni - Sun 01 December 2024 • Tagged with markowitz, portfolio, capm, volatility

I examine the coverage of random portfolios in log volatility—return space using Monte Carlo methods with different randomization techniques for the 2023 daily closing prices of the 100 stocks constituting the Nasdaq-100.

Marton Trencseni - Fri 22 March 2024 • Tagged with trading, sharpe, winratio, nasdaw

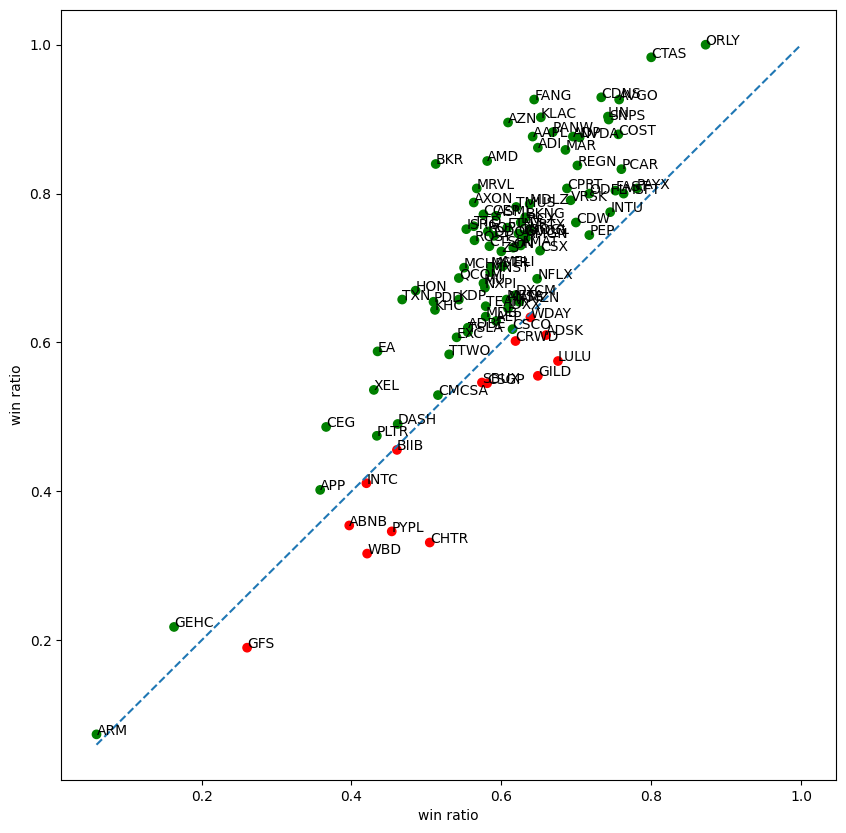

I clean up the code I wrote for earlier posts, and run simple trading experiments.

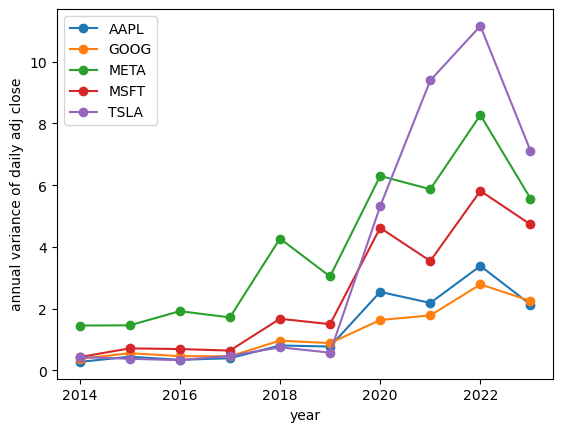

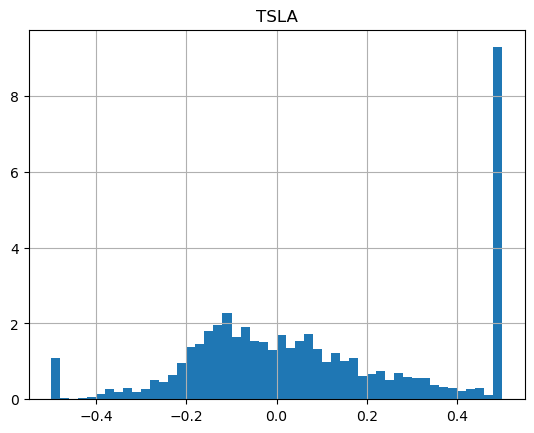

Marton Trencseni - Sat 09 March 2024 • Tagged with markowitz, volatility

I investigate the volatility of aggressive take-profit strategies on tech stocks.

Marton Trencseni - Sun 25 February 2024 • Tagged with markowitz, volatility

I investigate the volatility of some securities, and its stability over time.