Modern Portfolio Theory III: The Efficient Frontier in log volatility—return space

Marton Trencseni - Mon 30 December 2024 • Tagged with markowitz, portfolio, capm, volatility

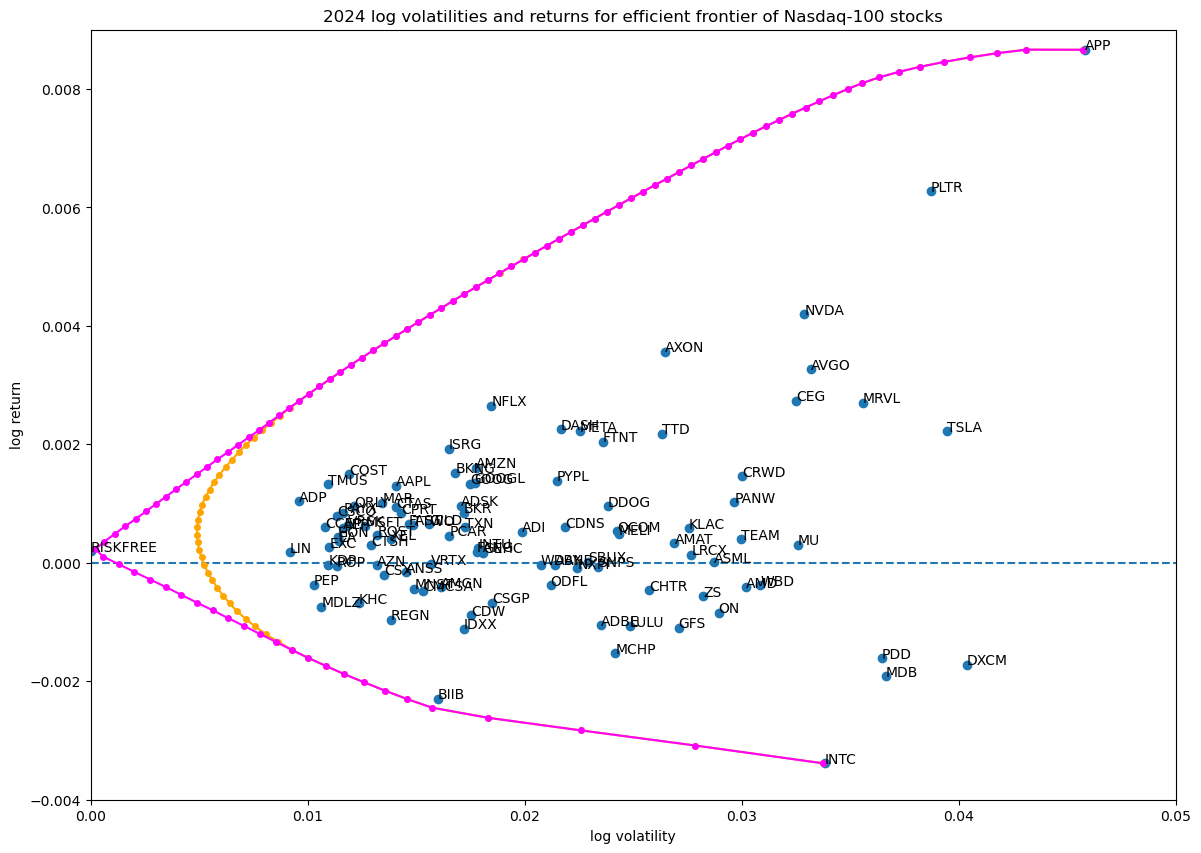

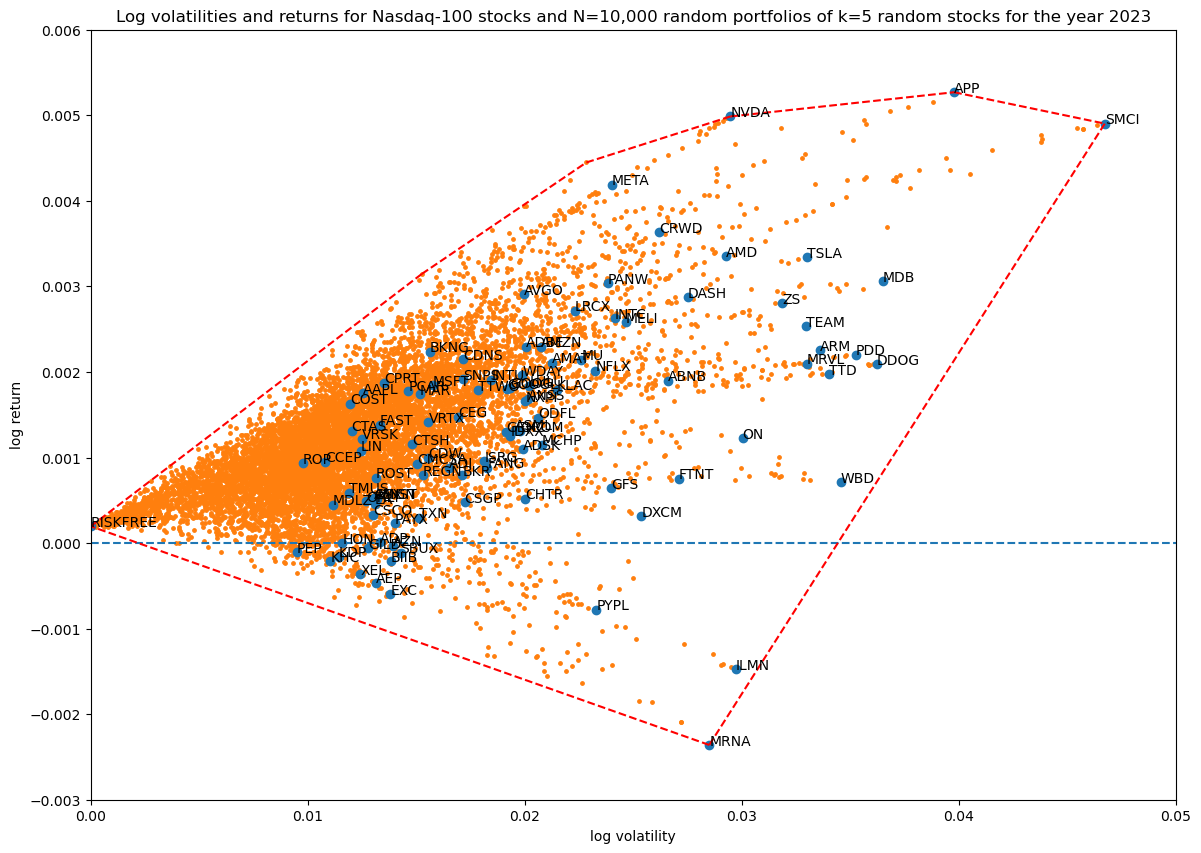

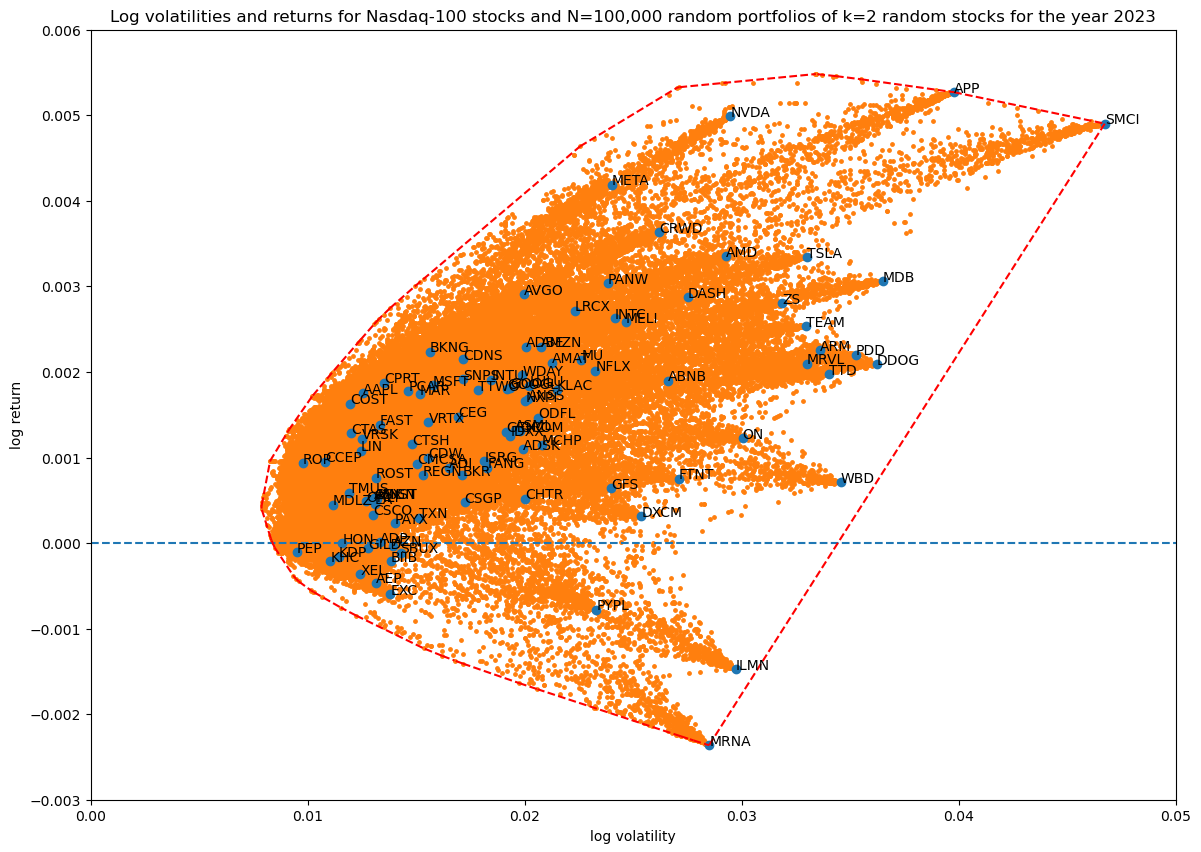

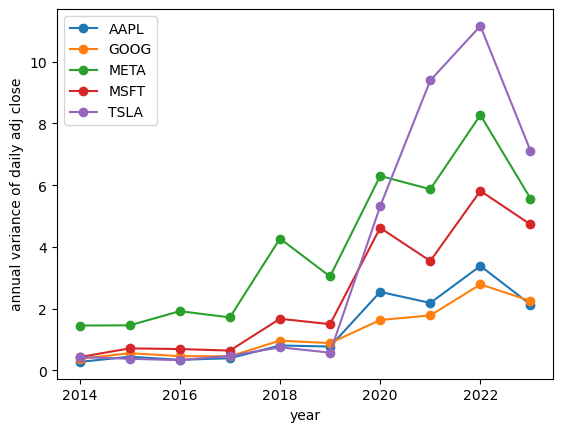

In the previous two articles, we explored the coverage of random portfolios in log volatility—return space, both with and without a risk-free asset. We now take the next step, and calculate the Efficient Frontier and Capital Market Line of Markowitz’s theory.